Once you hit send on those financial aid applications, what happens next?

Money doesn’t suddenly fall onto your doorstep, so where does it come from? In being a good consumer, it is good to know this information.

Where do financial aid dollars come from?

There are 4 primary sources of financial aid:

- Federal Government

- State Government

- College and Universities

- Private organizations/foundations

Types of financial aid

These four sources of financial aid give out 2 main types of aid funding:

These four sources of financial aid give out 2 main types of aid funding:

- Gift Aid (scholarships and need-based grants) – This is money that does not need to be repaid.

- Self-help Aid (loans and campus employment) – Students and/or parents must do something for this money by either repaying it or working hours and getting paid a wage.

The federal government provided 69% of financial aid for the 2013-2014 academic year. That makes them the largest source of financial aid funding (again, remember that this includes federal loan programs along with grants and scholarships).

Federal financial aid programs

Pell Grant

Gift aid that is allocated to the neediest students. It is determined by income, family size, number in college, and other factors. Award amounts are based on your Expected Family Contribution (which you will get as a result of filing the FAFSA), the Cost of Attendance at the college you’re attending and whether you are a full or part-time student.

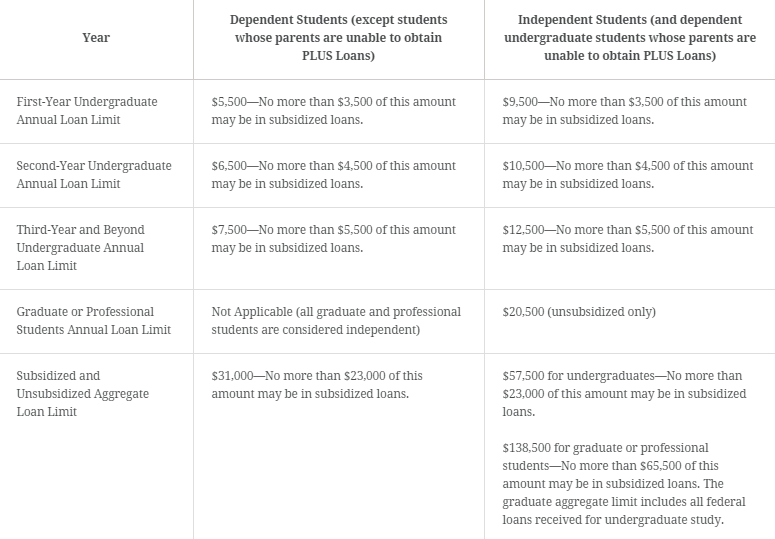

Direct Student Loan Program (formerly the Stafford Loan)

Any student, regardless of financial need, can borrow these funds. Students who meet financial need eligibility criteria can receive an interest-free loan (subsidized) during their college enrollment. Students who do not meet the need criteria can receive the same funds. However, they are responsible for the interest that accrues during the in-school period (unsubsidized).

This table shows limits on federal loan programs based on eligibility. Taken from StudentAid.Gov.

Other federal programs include the Perkins Loan Program, Federal Work-Study and the Supplemental Educational Opportunity Grant. Eligibility for all of these funds is determined by each college’s financial aid office.

State financial aid programs

State Governments often have their own state grant programs. It is intended to help defray the cost of a college education for students from that state who, in most cases, attend college in that state. Financial aid offices will communicate with your state’s higher-education agency to inform you of your eligibility for a state grant.

Institutional grants and financial aid

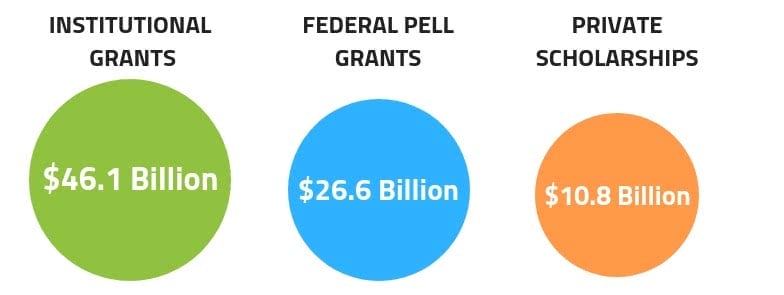

College/University funding

Colleges and universities are the largest sources of gift aid to undergraduate students*. While both public and private colleges provide gift aid to students, private colleges tend to have a much larger pool of these funds.

“Trends in Student Aid 2017” CollegeBoard

Families who may not meet the eligibility criteria for federal or state grants may still qualify for gift aid from the institutions themselves.

Outside scholarships

Private organizations/foundations

While this is often what families think of when they hear the word “scholarship”, in the grand scheme of things, this is one of the smallest sources of financial aid.

Going out and finding “outside scholarships” may be a worthwhile exercise. However, the amount of aid you are likely to get from these sources may pale in comparison to the other sources, especially federal and institutional sources. If you have the time, it cannot hurt to use one of the college search engines on the internet to find scholarships for which you may qualify. But, you’re most likely to get much more by finding a college or university that offers you a generous aid package on its own.

It’s also worthwhile to check with your high school guidance office to learn about local scholarships for which your odds might be much better.

*If aid to Veterans is included, the Federal government becomes the largest provider of grant funds

What year was this published, and where do you get your percentage statistics from?

Hello, Shawna! This particular article was published in 2015, using stats from StudentAid.gov and College Board.

Thank you so much! This is a great article and something I will be citing in one of my college papers this semester.