We know that not all school's Financial Aid Packages look the same. College Raptor's offer comparison tool helps you sort through the clutter and see what you are actually getting in the form of aid from each institution! Simply upload your letters, and College Raptor does all the hard work: highlighting grants and scholarships, calculating actual net price, loans, out-of-pocket costs, and estimating debt at graduation.

Show me my best offerStudent

What sets our tool apart?

- It's Easy: Uploading your offer letters is quick, easy, and convenient!

- It's Accurate: Our tool ‘reads' each offer letter and compares it with your personal financial circumstance to provide an accurate report of net price and estimated debt at graduation.

- It's Smart: Our system suggests whether your projected debt load is reasonable for the salary you are likely to earn upon graduation.

- It's Secure: We encrypt all of your information and keep it safe.

- It's Totally Free!

View Demo

Watch a full demonstration of how to utilize College Raptor's Financial Aid Offer Comparison Tool and find out which school is giving you the best deal.

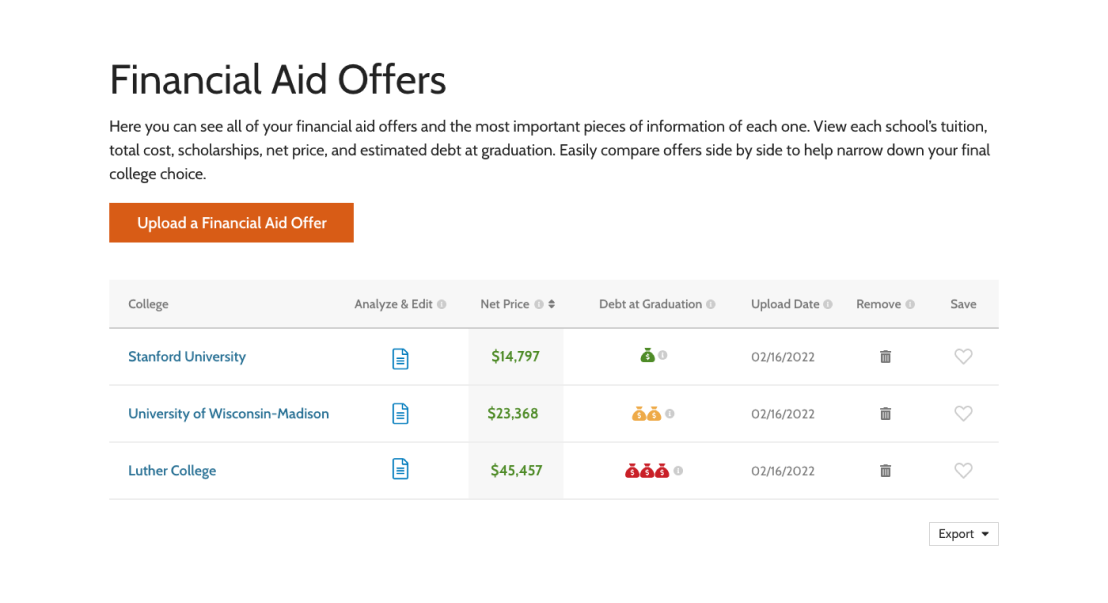

Financial Aid Summary Results

After you've uploaded or entered your offer into the Financial Aid Offer Comparison Tool, you will be able to see a summary of the offer:

- Tuition

- Total Cost

- Grants and scholarships

- Net price

- Estimated debt at graduation

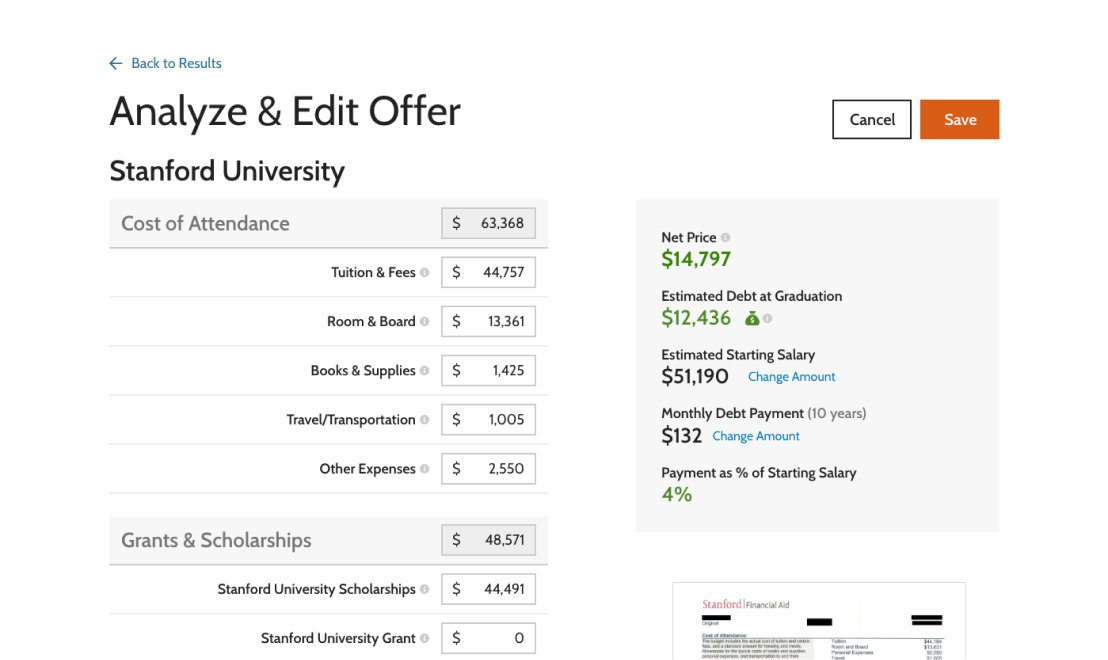

Estimated Debt at Graduation

The estimated debt at graduation is not a guarantee of what you will owe after your graduation. Our number is based on:

- How much your family pays per year towards your college expenses

- How many hours you participate in work-study

- Four-year graduation timetable

- The length of time you will take to repay the debt

What's the Difference between an Offer Letter and an Acceptance Letter?

An acceptance letter is what you receive from colleges informing you that you've been accepted into the school. They generally include a cover letter congratulating you and letting you know you've been accepted to the college. They will also include information about next steps, what to do if you want to attend the school, and any important deadlines you need to know.

A financial aid offer letter – also referred to as an offer letter or award letter – tells you where the money to pay for college is coming from: aside from any private student loans you might have. This information package details all of the aid you are being offered including:

- Institutional Aid

- Federal Student Loans

- Scholarship Awards

- Grants

Common Terms in Offer Letters

Understanding the terms in your offer letter is important to be able to make a proper comparison. However, interpreting the terms can get confusing as there is no standard format that all schools use. Here are some common terms you'll come across in your offer letter.

Cost of Attendance (COA): refers to the estimated cost of attending that particular school for one academic year. The COA usually includes tuition, room and board, fees, transportation, books, and supplies. The COA in the offer letter is just an approximate cost. Your actual cost may be more or less than the number supplied.

Student Aid Index (SAI): is used to calculate the amount of financial aid a student is eligible to receive, both from the federal government and from educational institutions, and is calculated based on the information you provide in your FAFSA. SAI is a replacement for the previously used metric call Expected Family Contribution, or EFC.

Financial Need: is the difference between the cost of attendance and your ability to pay for college. It is determined by subtracting your SAI from the school's COA. It's important to understand that the SAI is a fixed amount that's calculated using the information on your FAFSA. However, your financial need is not a fixed amount. Every college uses its own formula for calculating financial need. Your perceived need can vary greatly from one college to another.

Work Study: Work study programs allow eligible students to work part- or full-time on or near campus. Colleges operate these programs, but the federal government funds them. Not all students qualify for work study. If you ticked the work study box in your FAFSA and you qualify, your offer letter will include your work study details.

Gift Aid: is free money – you don't have to pay it back. Gift aid comes in the form of grants or scholarships.

Student Loans: can be federal or private loans. Most colleges and universities will not offer private loans as part of their offer letter, but there are exceptions.