How much does college cost?

This seems like it should be a reasonably simple question with a straight forward answer. However, that is not nearly the case. In fact, there are at least 4 answers to this question about college costs. Understanding them is important in being a good consumer.

1. Tuition and Fees

The biggest cost associated with college is tuition. It’s what a school charges to educate you.

The biggest cost associated with college is tuition. It’s what a school charges to educate you.

This figure covers teacher salary and benefits, fees to cover things like computer labs and science labs, the cost of classroom space and more. You can look at a college’s website and easily identify this figure. A community college may cost less than $4,000/year for full-time enrollment. In-state students may pay less than $10,000 for tuition and fees at a public university, and students at a private college may pay $40,000 or more.

2. Room and Board

Many who attend college will incur costs for housing and meals in addition to the cost of actually being educated. Whether you rent an off-campus apartment or live on-campus, there are still costs associated with this that are built into your college cost of attendance (COA).

3. Books and Supplies

Once you have paid for the Hard Costs, there are still other costs associated with a college education. These include books and supplies. Keep in mind that the cost of textbooks can quickly add up to hundreds of dollars or more per semester.

Once you have paid for the Hard Costs, there are still other costs associated with a college education. These include books and supplies. Keep in mind that the cost of textbooks can quickly add up to hundreds of dollars or more per semester.

These are considered “Soft” costs because these amounts are not billed by the college. But, they are still costs that you will incur and for which need to be prepared.

4. Personal costs

Other “Soft” costs include things like personal needs, travel expenses, etc.

These costs are nearly impossible to predict for an “average” student. Take a look at your situation to plan how much you’ll need to cover these costs.

Your actual cost may be less than you think

The final and most important cost related to a college education is what it will cost YOU.

The final and most important cost related to a college education is what it will cost YOU.

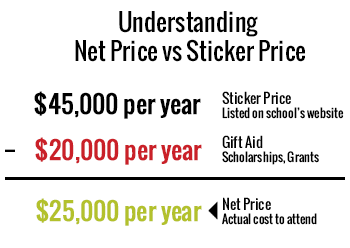

The tuition, fees, room and board figures that colleges list on their websites are what are also known as the Sticker Price. This is simply the starting point, but there are good odds that your family may pay something less than the sticker price.

Paying for college is a little bit like paying for a stylish new pair of boots. Some people will pay full price, but many people will pay a sale price.

In the case of college, this price is called the “net” price. That is, the price after any grants, scholarships and other forms of gift aid from the federal or state governments or the college itself. Many students receive various types and amounts of grants, depending on what they qualify for based on academic performance (merit aid) and their financial situation (need-based aid).

College Raptor’s match is a good place to get an idea for which colleges may offer you the best financial aid. It compares and matches you with colleges based on your academic interests and also on net price, to help you find which schools will actually be most affordable.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.34%-15.96%* Variable

3.99%-15.61%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

4.92% - 15.08% Variable

3.99% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.50% - 17.99% Variable

3.45% - 17.99% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.00% - 13.75% Variable

3.99% - 13.75% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

5.50% - 14.56% Variable

3.69% - 14.41% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

3.70% - 8.75% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

4.99% - 16.85% Variable

3.47% - 16.49% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

5.00% - 14.22% Variable

3.69% - 14.22% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |

Is it helpful to know my EFC as I use the net price calculator?