Flickr user San Francisco State

For students looking to earn a degree, financial need is a major area of concern. It’s also a huge deciding factor when it comes to choosing a college. The cost of school deters many people from even considering the pursuit of higher education. It seems so unaffordable for those with a low to average income. So, how can students graduate from college with no debt? Is that even possible?

College is expensive

For example, high school students with great GPA’s of a lower socioeconomic status may not attend college because their families are unable to afford it. Working parents who want to go back to school may decide to continue working at a lower paying job to avoid putting their entire family in debt. These concerns are not unwarranted. According to the College Board’s 2018-2019 annual survey, a public 4-year university charged approximately $9,410/ year for in-state tuition and $23,893 for out-of-state tuition.

Many students aren’t sure if they can afford college

Tuition, fees and other related expenses continue to rise. Many students are unsure if they are able or willing to shell out the money for higher education. According to a 2014 survey of Generation Z respondents (born mid-90’s or later), 80% agreed that earning a college degree was very important in securing a successful career. However, 67% also expressed concern about whether or not they can afford college and pay off their student debt. Unfortunately, the result of these concerns is that people choose to opt out of college altogether. One-third of the survey respondents agreed that the cost of college outweighed the benefits and it was not worth it to them to attend.

Can you graduate from college with no debt?

Are you a current or potential college student wondering whether it is possible to graduate from college without getting too much into debt? Well, the answer is yes. You’d be surprised how many students are able to graduate, every year, with zero debt. This may sound crazy and impossible, but it’s not!

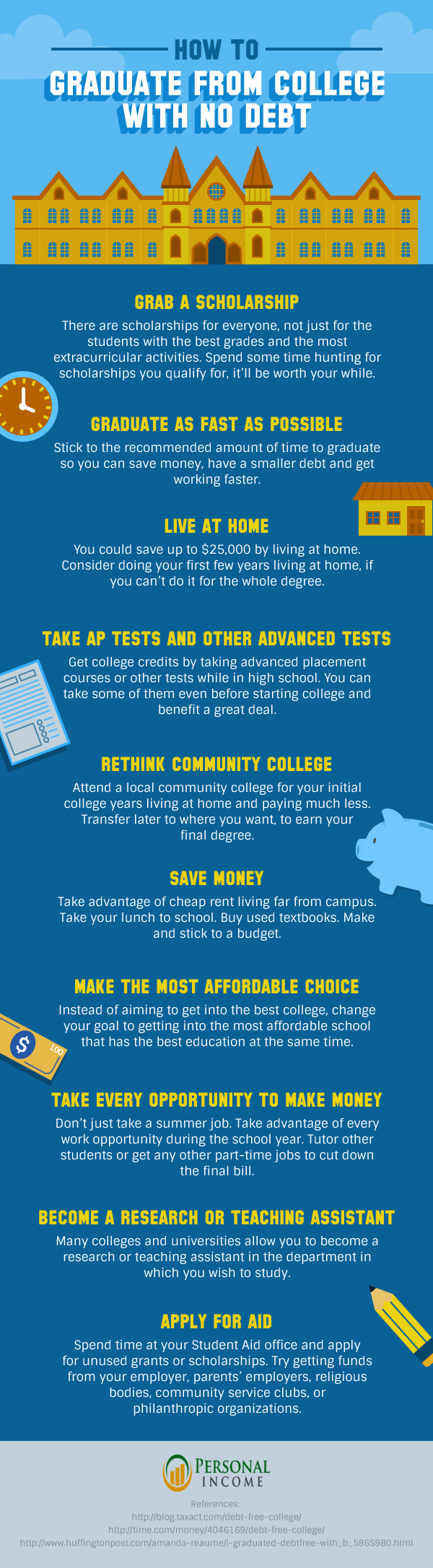

There are many ways you can cut back on the cost of attending college. Unfortunately, many people may not know about these tricks. Below, you can find a helpful infographic that lists ten proven tips on how you can graduate from college without owing tons of money in students loans!

Here at College Raptor, we aim to make personalized colleges matches for each individual. Instead of just the sticker price, College Raptor can show you the net price. The net price is what you’re more likely to pay once scholarships and financial aid are taken into consideration. This means expensive colleges may actually be more affordable than you thought! In fact, sometimes elite, expensive schools are actually the option that will save you the most money!

Use our college match tool and see what your net price could be, and also what sort of financial aid you could receive from schools all over the country. Don’t just settle for a college, find the one that’s right for you!