You’ve probably heard horror stories about students who pay $60,000 plus every year to attend college. If you’re an average middle-class college hopeful, this can be disheartening. It seems like college is for rich kids only, and not as accessible to other students.

The good news is that the most-often quoted price–the sticker price–is paid by just 1 in 3 college students.

Low-income students get the most financial aid, not just scholars and athletes

Another common misconception that scares many students and families away from college is that they don’t expect they’ll qualify for financial aid.

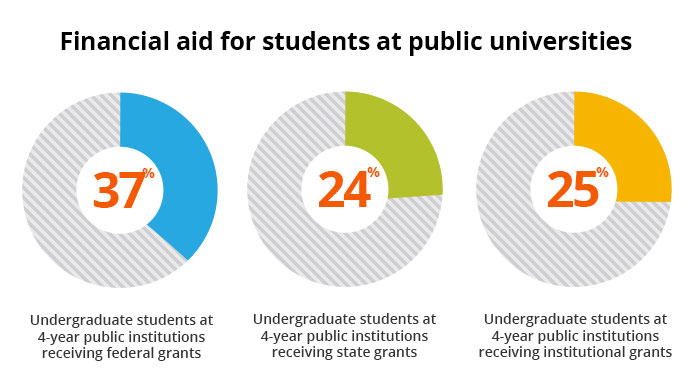

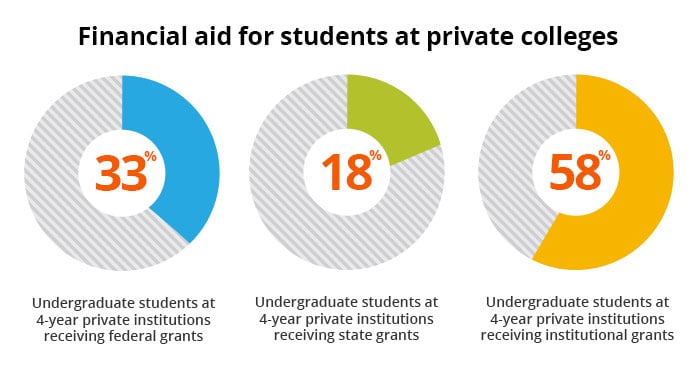

This is statistically unlikely, as nearly 40% of undergraduate college students qualify for PELL grants. Federal grants are reserved for the most needy students. About 25-58% of students receive institutional grants that offset the costs of college. In addition, approximately 18-24% of undergraduates also receive state grants to help fund their education.

All told–the cost of college may not be nearly as high as you expect. Of course, consider what help there is to help you pay for college.

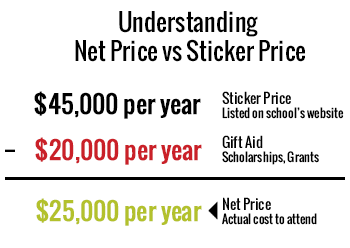

Compare college net prices–not sticker prices

When considering whether you can afford college, look at your net price at that college instead of the advertised cost of attendance. Calculate your net price by subtracting your estimated gift aid by the school’s sticker price. This is the approximate amount it will cost you to attend a college after financial aid.

When considering whether you can afford college, look at your net price at that college instead of the advertised cost of attendance. Calculate your net price by subtracting your estimated gift aid by the school’s sticker price. This is the approximate amount it will cost you to attend a college after financial aid.

Many of the most expensive colleges offer need-based aid on a sliding scale. This means that the less your parents bring home, the more aid you may be eligible to receive. Top tier colleges in particular commit to assisting students in need. Vanderbilt University commits to meeting 100 percent of a student’s need through grants.

Even if you think you can’t get into Vanderbilt, pay attention to your net price at other private institutions. The affordability may surprise you.

College sticker prices can be alarmingly high, but don’t convince yourself you can’t afford college just yet. College Raptor can help you predict a net price, (what college is likely to cost YOU) making college comparisons easier and more meaningful.

Shop smart to reduce your student loan debt

Another scary part of the price of college is the debt that comes after graduation.

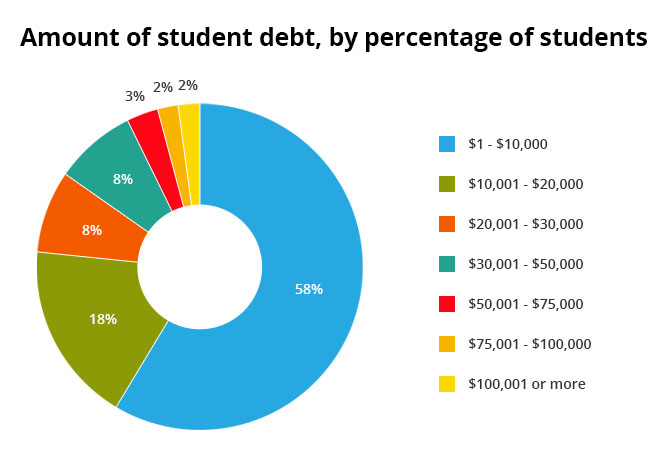

As a student, will you end up buried in $150,000 in debt?

Source: Brookings Institute

Again, chances are no. Statistically, very few students graduate with anywhere near that much debt. In fact, more than half of all college undergraduates come out of college with $10,000 or less in total student loan debt.

Affordable student loan options exist

Lastly, keep in mind that there are numerous federal loan programs that offer low-interest and subsidized options to pay for school without gouging on interest after graduation. All told, this means that with a little comparison shopping to find the right deal, college can be much more affordable and accessible than students may think.

Use College Raptor’s free Student Loan Finder to compare lenders and interest rates side by side!

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.19% - 15.81%* Variable

3.99%-15.61%* Fixed |

Undergraduate and Graduate |

VISIT CITIZENS |

|

4.79% - 14.96% Variable

3.49% - 15.49% Fixed |

Undergraduate and Graduate |

VISIT SALLIE MAE |

|

4.38% - 17.99% Variable

3.39% - 17.99% Fixed |

Undergraduate and Graduate |

VISIT CREDIBLE |

|

5.34% - 13.19% Variable

3.48% - 12.61% Fixed |

Undergraduate and Graduate |

VISIT LENDKEY |

|

5.25% - 14.26% Variable

3.39% - 14.16% Fixed |

Undergraduate and Graduate |

VISIT ASCENT |

|

3.70% - 8.75% Fixed |

Undergraduate and Graduate |

VISIT ISL |

|

4.99% - 16.85% Variable

3.47% - 16.49% Fixed |

Undergraduate and Graduate |

VISIT EARNEST |

|

5.00% - 13.97% Variable

3.69% - 14.22% Fixed |

Undergraduate and Graduate |

VISIT ELFI |