How Do Students Afford Colleges That Are Very Expensive? – College Raptor Q&A

For the 2014-15 school year, the published costs of attendance at Harvard and Stanford are approximately $65,000 and $62,000, respectively. These numbers can easily be discouraging for those who want to afford colleges, especially for students from low-income families.

Even students who are well qualified for top-tier colleges may shy away from applying, thinking that they could never afford the bill or that it would bury them in student debt.

But those wary of applying to these highly selective schools because of the price tag should consider the actual annual cost of attendance — the “net price” — before making up their minds.

Making expensive colleges affordable: What you need to know

- Top schools tend to be generous with need-based aid, usually because they have more funding. That means more grants and scholarships, which is money that doesn’t have to be paid back

- Harvard, Stanford, and similar schools emphasize the importance of reducing student loan debt

- Stanford’s sticker price is $56,979, but the lowest income group (income below $60,000 annually) will pay an average of only $4,540 a year

Over sixty percent of students at Harvard and Stanford pay for college with the help of need-based grants

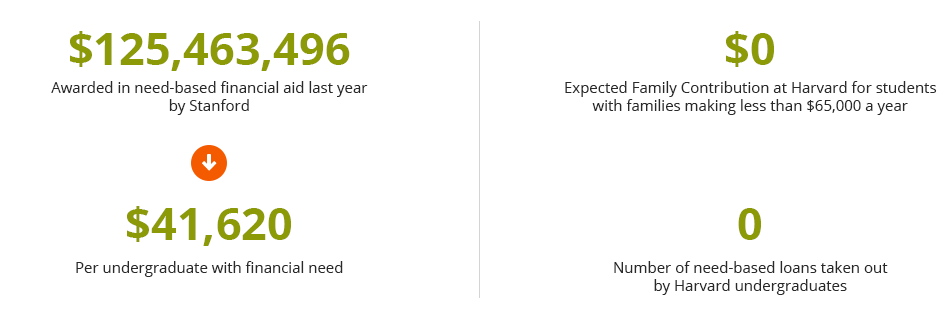

Harvard claims that for 90 percent of American families, it’s actually cheaper to go to Harvard than a state school. How is this possible? Harvard offers grants on a sliding scale. Students whose parents make less than $65,000 a year contribute $0 toward tuition and fees and Harvard pays the difference.

Grants decrease as income increases in such a way that the financial burden is at a consistently low level. Harvard also stresses that no student will be forced to consider loans to pay the bulk of the cost.

Similarly, Stanford commits to making itself accessible to any eligible students by practicing need-blind admission. This means that a student’s admissions decision is not based on their ability to pay for or afford college. All undergraduates are eligible to have 100 percent of demonstrated need met through grants. In 2013, 77 percent of graduates left Stanford debt-free.

Harvard and Stanford seek to develop smart, interesting, and diverse classes

Ivy League colleges do not give merit scholarships–only need-based aid ones. Harvard, Stanford, and similar colleges are committed to building the most interesting, diverse, and intelligent classes possible. That’s why they commit to making themselves as accessible (and affordable) as they can to all admitted students.

Since all students at Harvard, Stanford, and similar college are exceptional in some way, awarding merit aid doesn’t make as much sense. Instead, they focus on helping needy families afford the cost of college to make their institution more accessible to low-income students.

Almost any student admitted should be able to afford college tuition and fees at Harvard or Stanford

If you are interested in Harvard or Stanford, don’t rule out applying just because you think you can’t afford college. Schools like these offer a lot of need-based aid, so students should concern themselves with the net price rather than the sticker price.

I am currently a student at a Idaho State University. I don’t talk to or have any support from my family to help me co-sign for educational loans. Is it still possible for someone like me to transfer to an Ivy League and how is it possible? I’m not on a full ride right now but I’d do anything to attain one or be able to apply to a top level school without having to pay so much. Help….

Hi, Michael. Fortunately people outside your family can co-sign for a student loan–you can read more about that here! Transferring can be tricky, but Ivy League schools can give out impressive award letters. Check out College Raptor’s free match tool to see your personalized net price estimate, which includes the likely financial aid package you could get from the school! You can also see your estimated debt upon graduation. Hope this helps!