LendKey offers borrowers a way to refinance their student loans using local and regional credit unions, and community lenders.

Going local is one of the main reasons people choose to use their service over other competitors, which tend to be large national or multinational corporations or services that connect borrowers with those lenders.

Borrowing from a smaller community lender isn’t for everyone. However, it can offer some peace of mind for those who like to do business with local organizations.

Why Refinance Through a Community Lender

LendKey’s pitch is pretty simple: Refinancing your student loans through a credit union or community lender is better. They are non-profit organizations that care more about individuals than their corporate lender counterparts. “People over profits,” as they say.

This is a pretty common characterization, although it may not hold true in all scenarios. There has been some movement, as of late, for individuals to move from banking and lending with the Bank of Americas of the world to choosing local organizations.

There may be a few drawbacks in terms of size and scale. However, there is generally more flexibility that comes with a local/regional bank and their ability to generate familiarity with their individual members. In other words, you are less likely to be treated like “just a number”.

Although less of a direct effect on you as a borrower, one other reason that many people choose to work with local credit unions is that the money generated by the organization is more likely to stay in the local economy. It can be used to create jobs, pay for new cars or homes, and be lent to other individuals in your city or area, rather than turning into corporate profits that all flow back to New York City, or wherever a corporate bank may be headquartered.

How LendKey Works

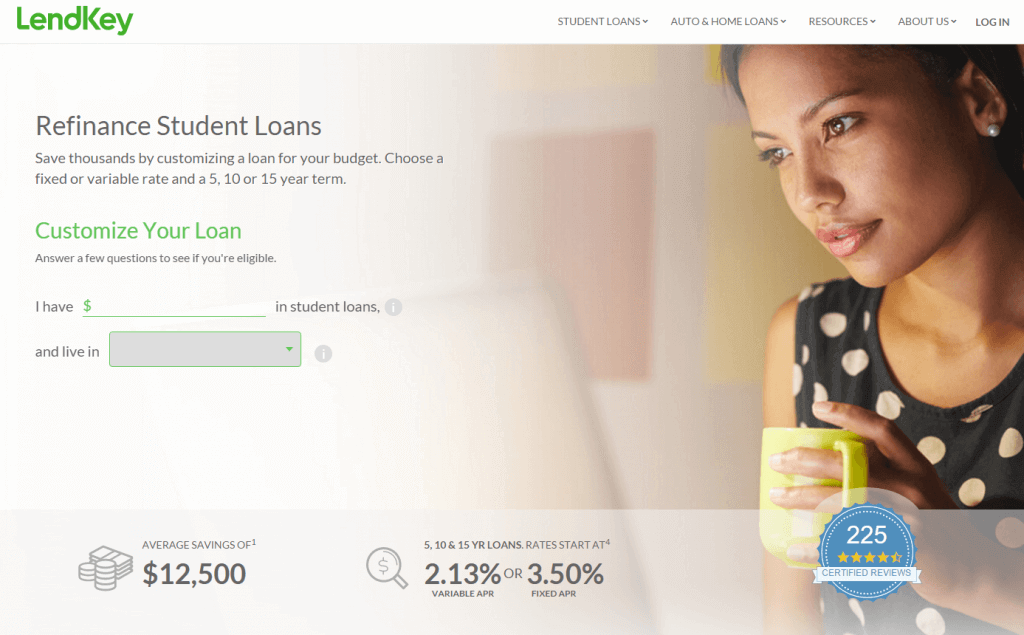

LendKey.com

LendKey has a network of local and regional lenders around the country that provide student loans and refinance/consolidation options, in addition to home and auto loans.

As a user, you go through a quick process to be pre-qualified based on your location, loan amount, and educational history. This process makes sure that you live in an eligible area and have the basic credentials needed to become a borrower.

LendKey will perform a “soft” credit check (meaning that it won’t appear on your credit history) to show you some estimated rates at various lenders that serve your area.

They’ve recently made improvements to their platform that allow you to see offers from multiple lenders, essentially creating a “marketplace” for you to compare rates and terms. It’s a pretty nice addition.

Once you choose a lender, you’ll need to complete an actual credit application that will then be used to determine your final rate and terms offers.

At this stage, you are actually authorizing this lending institution to do a check on your credit and verify your details.

Although LendKey is not the lender (i.e., they aren’t the ones issuing any student loans), they are the servicer for your loan. They promise not to sell you off to a third party as soon as you sign the paperwork.

LendKey Interest Rates and Terms

Interest rates:

- Fixed-rate loan

- Rates starting at 2.95% APR with auto-debit

- Variable-rate loan

- Rates starting at 1.92% APR with auto-debit

- Rates will vary based on available lenders

- Individual rate will be determined by credit history and repayment terms

- Learn more about fixed-rate versus variable-rate loans when you refinance

Loan terms and eligibility:

- Amounts: $7,500 – $125,000 ($250,000 for graduate degrees)

- Duration: 5, 7, 10, 15, 20 years

- Not available to residents of Maine, Nevada, North Dakota, Rhode Island, or West Virginia

LendKey Student Loan Refinance Credit Standards

Because LendKey is not a lender, they work with a network of institutions from around the country. Thus, credit standards and rates tend to vary.

That being said, credit unions and community banks are most commonly known for offering more flexible underwriting than corporate banks. This means that you may be able to more easily qualify for favorable loan terms and rates by using LendKey to find a local lender.

What There Is to Love About LendKey

If you value the institutions that you do business with and you try to support local and small businesses whenever possible, LendKey makes the process of finding a lender a breeze. You won’t have to call around to all of the local credit unions in your area and then try to compile and compare offers. Instead, simply complete one application to get information from multiple, local institutions.

Not only do they connect you with local and regional lenders, but they service your loan in-house. That is a big deal for anyone who has felt the pain of being juggled around by multiple loan servicing companies.

Here are the benefits that LendKey offers:

- Industry competitive interest rates

- Local/regional not-for-profit lenders

- Lifelong loan servicing relationship

- 18-month unemployment protection

- Flexible underwriting