Pixabay user 0TheFool

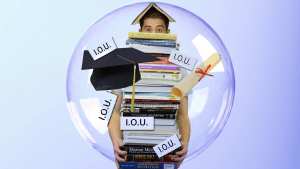

A new year almost always means new goals and resolutions for many students and former students. Along with getting healthier, one of the top New Year’s resolutions is to pay off debt and save money. Student loans account for a large amount of debt for many people. Getting them paid off can be an overwhelming goal, but is definitely not impossible. By applying some smart tips to your debt payoff plan you can be rid of that crushing debt in no time. Here are some tips to help you understand student loans and end the year debt-free:

Know What You Owe

Many students considered only how they would pay for college in the moment, but did not consider how much those student loans would amount to in the long run. By graduation students are often surprised by the actual amount that they end up borrowing. By figuring out the amount you have borrowed as well as the interest rate and loan terms you can plan more effectively for paying off your debt.

Figure Out a Budget

Once you have fully calculated your total debt, now you can set a plan in motion to start repaying. To help you find the best way to start repayment you should consider how regular payments to your loan can fit into your budget. There are many money-saving apps for college students that can help you keep track of your expenses and help you save money. Many of these apps also have features such as bill pay reminders and calculators that can help you see where you spend too much or your income-to-debt ratio. Helpful tools such as these can be a simple but efficient way of tackling your student loans in the new year.

Start Repaying Today

If you want to truly get rid of student loans, the best approach is to start repayment today. Even if you are still a student, making regular payments can help reduce what you owe when you finally graduate and make it easier for you to pay off the rest. Make sure you know what kind of loan you have and the loan terms because some private loans might actually charge you for making payments early. Also, make sure your payments are going towards the principal amount and not the interest. Paying off the principal versus the interest amount makes a big difference in how your debt gets paid off.

Pay A Little Extra

Paying just the minimum charge on your debt might seem like a good way to manage your student loans into your monthly budget, but paying a little extra if you can manage to will ultimately pay off in the long run. By paying even just a small amount extra to your student loan you can actually save more money later on. Think about cutting small expenditure such as buying lattes or meals in restaurants and use that money towards your loan repayment. The average cost of a latte from a café is about $3 and buying one every day for a week is about $21. In a month, you could save almost $100 that could go towards your student loan repayment.

Make Some Extra Cash

There are plenty of ways to earn some extra cash to help supplement paying your student loans. There are some creative ways to pay for college that you can do during your spare time. If you’re the artsy or crafting type, you might want to consider selling your work online using websites such as Etsy or Big Cartel to start your own online shop. You can also take online surveys that pay participants small stipends per survey. If you have a car you can also consider driving for companies such as Uber or Lyft to make some extra cash and at the same time get to know your city and new people. Using this extra cash, even if it’s just a small amount will save you from spending more on your student loans in the future and make it quick to pay them off.

If you want to truly understand how to start paying off your student loan in the new year the best strategies often are the most simple ones. Creating a budget and sticking to it as well as seeing how your student loans fit into your current spending can help rather than making your other expenditures fit around your student loans. Paying off loans can be overwhelming but implementing some of these small changes can help you get the large number of debt to zero.

—

Use College Raptor to discover personalized college matches, cost estimates, acceptance odds, and potential financial aid for schools around the US—for FREE!