Student loan refinancing and student loan consolidation are popular methods of saving money or managing loan payments. But how do they work? Should you consolidate and refinance student loans? What are the pros and cons? We’ll answer all that and more in this guide.

What Is Student Loan Refinance?

Refinancing means the individual receives a new student loan for an existing loan or loans. The lender technically pays off your existing loan(s) and gives you a new loan with different terms, such as a different repayment period, interest rate, or monthly payment.

4 Reasons to Refinance Your Student Loans

Let’s start with refinancing. There are a number of reasons to refinance your student loans, including:

- Lower interest rates. One of the biggest benefits of refinancing and a common reason borrowers choose to refinance is to get lower interest rates. If you have a strong, established credit history with solid income and a low debt-to-income (DTI) ratio, you could qualify for a lower interest rate compared to your current loan and save thousands in the long run.

- Switching from variable to fixed interest. Variable interest rates change on a regular basis, depending on the current market and prevailing interest rates. A fixed interest rate gives you a better understanding of how much you’ll owe in the long run and takes guesswork out of the equation.

- Lower monthly payments. For borrowers struggling with current monthly payments, refinancing can extend the loan terms. This lowers the monthly required payment and can help you avoid defaulting.

- Release a cosigner. If you have a cosigner on a private student loan, the only way to release them from their obligation is to refinance.

Keep in mind that if you extend the term of your loan, you could end up paying more in the long run due to the additional accumulating interest. You can avoid this by paying more than your monthly minimum payment as soon as you’re in a comfortable financial situation. Unlike many other types of loans, most student loan lenders won’t penalize you for paying off the balance and interest faster than expected.

Borrowers can also opt for reduced loan lengths, which will increase the monthly payment minimums, but this route could be ideal for those eager to pay off their student loans.

Interest Rates and Refinancing

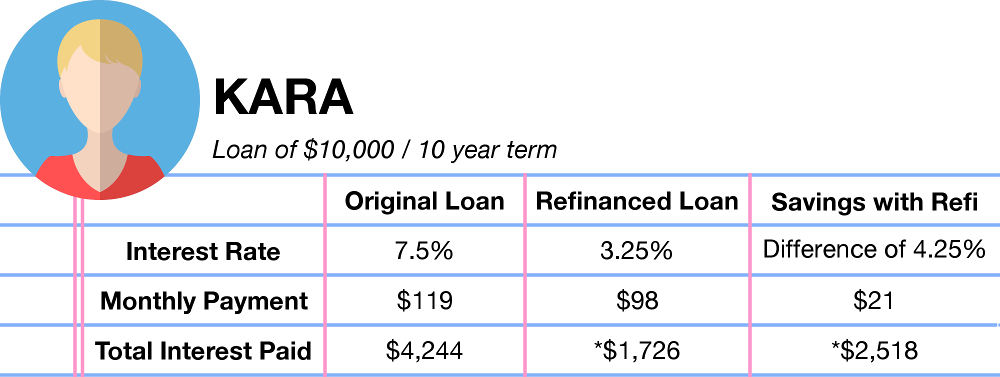

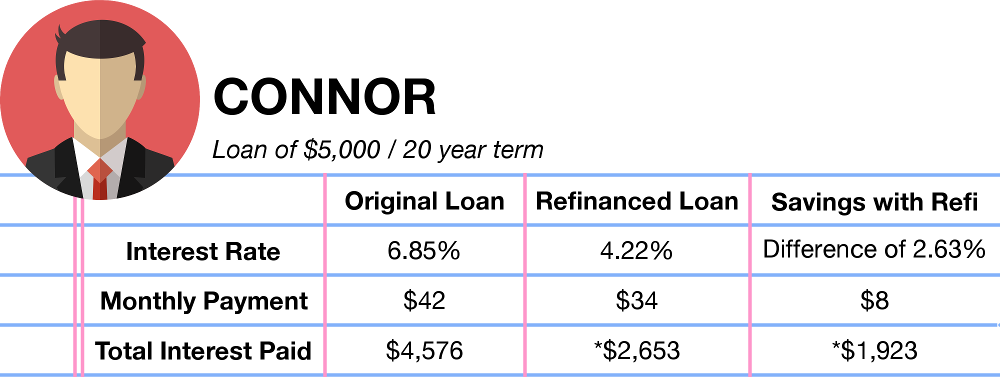

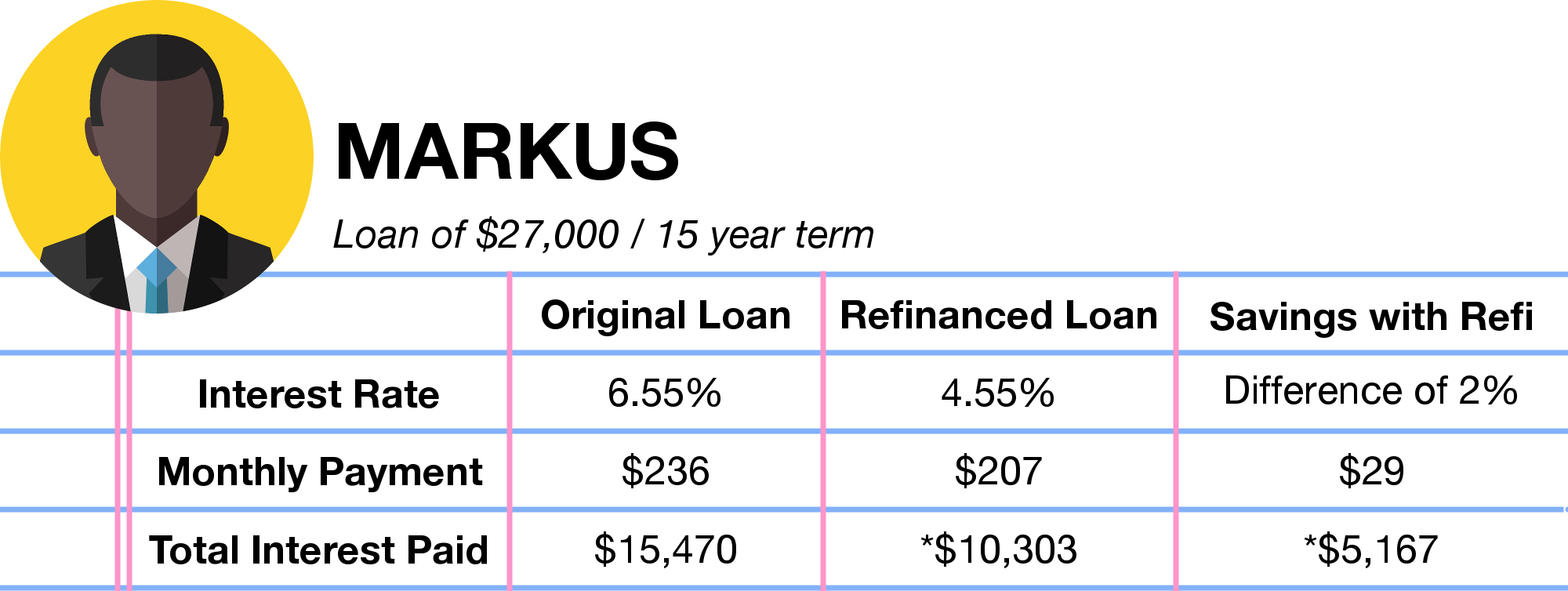

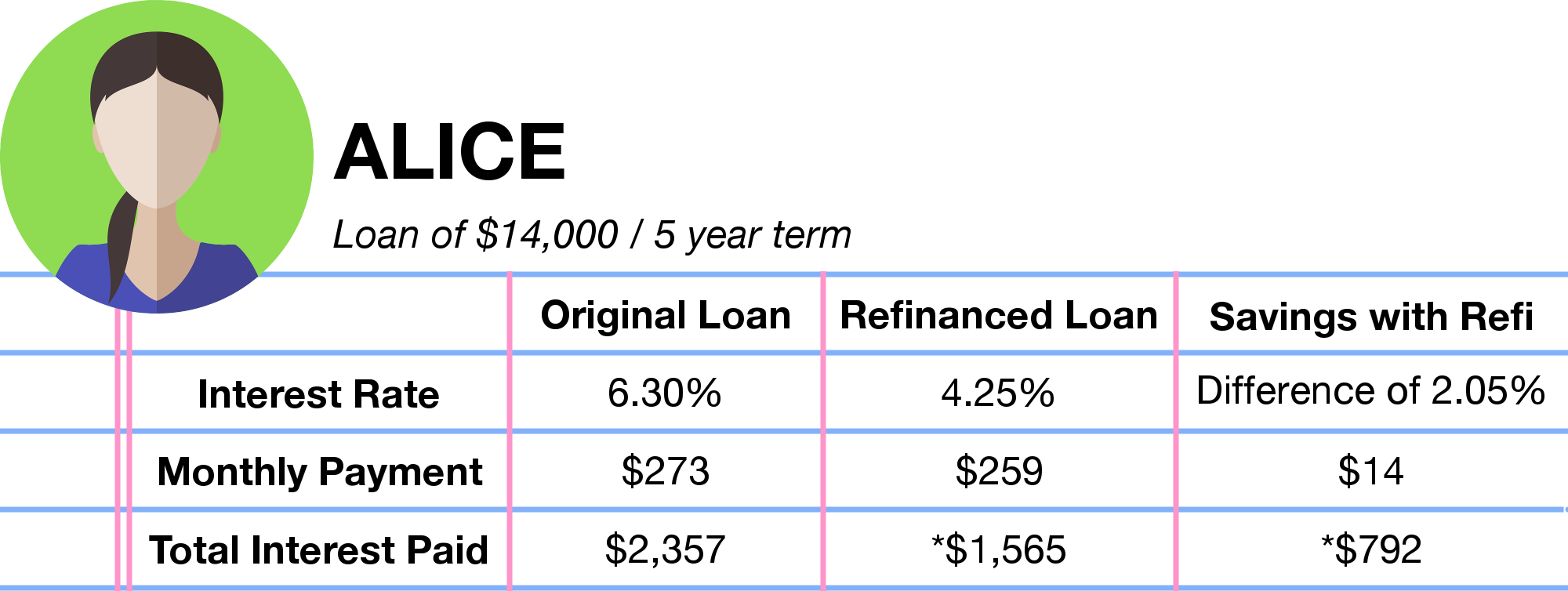

A lower interest rate sounds all well and good. But, how much does it actually impact your student loan? We want to really emphasize how much an interest rate can affect the total cost of a loan. Let’s look at these examples.

*Note: “Total interest paid” and “savings” will depend entirely on when you refinance the loan. Keep in mind, these numbers are meant to highlight how much an interest rate will affect the total cost of the loan, rather than actual calculations of potential savings.

When Should You Refinance Your Student Loans?

You can refinance student loans whenever you’d like, but the best time to refinance student loans is after you’re earning a stable income, made a few successful repayments, and managed to build your credit history. Lenders often offer better interest rates to borrowers who meet these three requirements. The earlier you refinance your loans at a lower rate of interest, the more you will save in interest payments.

It could also be time to consider refinancing when interest rates are favorable. Taking a look at the current student loan refinance rates can help you select the best time. In addition, you can refinance as many times as you’d like, if you qualify for the new terms.

Can You Refinance Federal Student Loans?

Yes, you can refinance federal student loans, but it can only be done through a private lender, such as a bank, credit union, or other financial institution – not the government. Federal student loans come with several benefits, including default protection, income repayment plans, and forgiveness programs. These federal protections are forfeited when borrowers refinance, so this option should be considered carefully.

How To Refinance Your Student Loans

If you’re thinking about refinancing your student loans, first compare your options. You’ll want to shop around to find the best rates and terms, ideally waiting until interest rates are lower. While you might be able to refinance through your original lender, going with a different financial institution could result in more favorable terms, as they wish to gain your new business.

Borrowers will need to apply with the lender they’ve chosen and gather documentation on income, assets, bank statements, and current loan details. If you haven’t been able to establish good credit, you’ll likely need a cosigner.

Always read over the terms, contract, and fine print before refinancing.

Is Refinancing Right for You?

Ask yourself these questions before you decide to refinance your student loans:

- Am I looking for a lower interest rate?

- Do I want a shorter repayment period?

- Am I looking for lower monthly payments?

- Am I willing to give up federal benefits for any of the above?

- Do I have good enough credit / can I build better credit?

- Do I have a steady income?

If you can comfortably answer “yes” to the majority of these questions, you might be ready to refinance your student loans.

What Is Student Loan Consolidation?

Although refinancing and consolidation are used interchangeably, they’re actually different. Student loan consolidation takes multiple student loans and combines them into one single loan. The terms may or may not change.

If you’re refinancing several student loans under one single loan, you’re also consolidating them. However, not all consolidated loans are refinanced.

Reasons To Consolidate Your Student Loans

In almost all cases, consolidation is used solely by borrowers who have several federal student loans on different payment schedules. Combining your loans into one makes it easier to track deadlines and lowers your default risk.

The federal government has a consolidation program, so you don’t have to worry about going through a private lender. If you’re consolidating private loans, you’re likely also refinancing them.

When to Consolidate Your Student Loans

You can consolidate whenever you’d like. The sooner you consolidate your loans to one payment deadline a month, the easier it is to manage your finances and avoid defaulting.

If you’re refinancing and consolidating, you’ll want to wait until you’ve established a good credit history and keep an eye out for favorable interest rates.

How To Consolidate Your Student Loans

Students who wish to consolidate their federal student loans can head to the Federal Student Loan (FSA) website from the Department of Education to learn more about their no-fee Direct Consolidation Loan program. Students can also select a new repayment plan.

Parent PLUS loans can’t be consolidated with loans taken out by the student, and private student loans can’t be consolidated through the government.

Is Consolidation Right for You?

Ask yourself these questions before consolidating:

- Did I take out multiple student loans?

- Do I have federal or private student loans?

- Am I finding it difficult to stay on top of several payment deadlines?

- Should I refinance while consolidating?

Did you answer “yes” to a majority of these questions? Then, it may be time to consider consolidating your loans.

How to Pick the Right Student Loan Lender to Consolidate and Refinance Your Student Loans

Of course, you want to pick the right lender and get the best deal. We recommend evaluating several potential lenders before refinancing or consolidating. You should compare:

- Interest rates. Interest rates change often and vary from institution to institution. Shop around when interest rates are lower than average to get the best detail.

- Loan terms. Are you going to a longer or shorter loan term? How does this impact your short-term and long-term financial needs and goals?

- Fees and discounts. Most private lenders don’t charge for a refinancing or consolidation application (the federal government doesn’t) but keep an eye out for any monthly fees or promotional discounts you could qualify for.

- Customer service and reviews. Check out the lenders’ customer service history on trusted review sites and think about your own interactions with the company. If you had a poor experience during the application process, you may want to consider a different lender, even if they offered favorable terms. This could be a sign of larger issues just around the corner.

- Borrower protections. The government offers protection for borrowers struggling to pay back student loans, and some private lenders do as well. They may have programs available if you should run into unemployment or other financial hardships that help you avoid defaulting or receiving high late fees.

Refinancing student loans or consolidating loans isn’t a process that can be completed overnight. It requires a bit of legwork to find the best terms for your financial situation and overall lending experience. If refinancing sounds like it would be ideal for you, we recommend comparing student loan refinance rates now.